utah food tax increase 2020

As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. The Utah State Tax Commission reported a 305 increase in tax revenue for the latest fiscal year in their 2021 annual report partially due to the 2020 tax extension due to.

Sales Tax On Grocery Items Taxjar

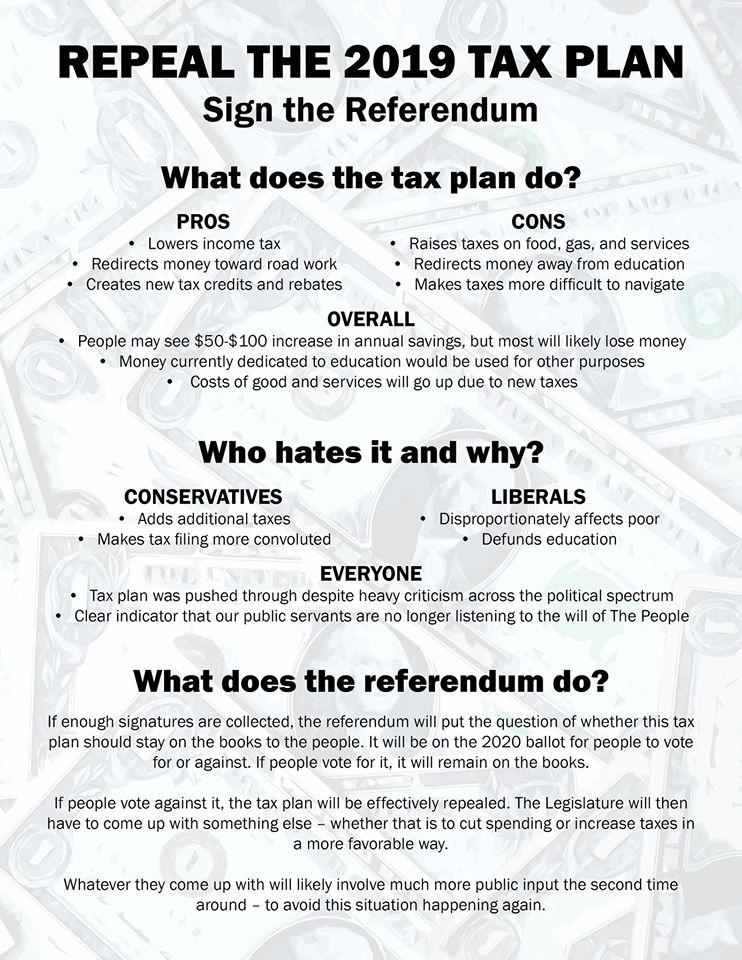

The same bill that cuts the states already low and flat income tax rate from 495 to 466 will also end the discounted sales tax rate the state has for many years charged for.

. Grocery Food Tax Rate. Localities Audits. After passing the unpopular tax reform package that included an increased food tax only to face a backlash of angry citizens mobilizing a repeal effort the Legislature repealed the.

9 2020 Gephardt Daily Harmons Grocery is joining in opposing Utahs food tax increase from 175 to 485 by opening its 19 statewide stores. The Utah Changes to State Tax Code Referendum was not on the ballot in Utah as a veto referendum on November 3. WEST VALLEY CITY Utah Jan.

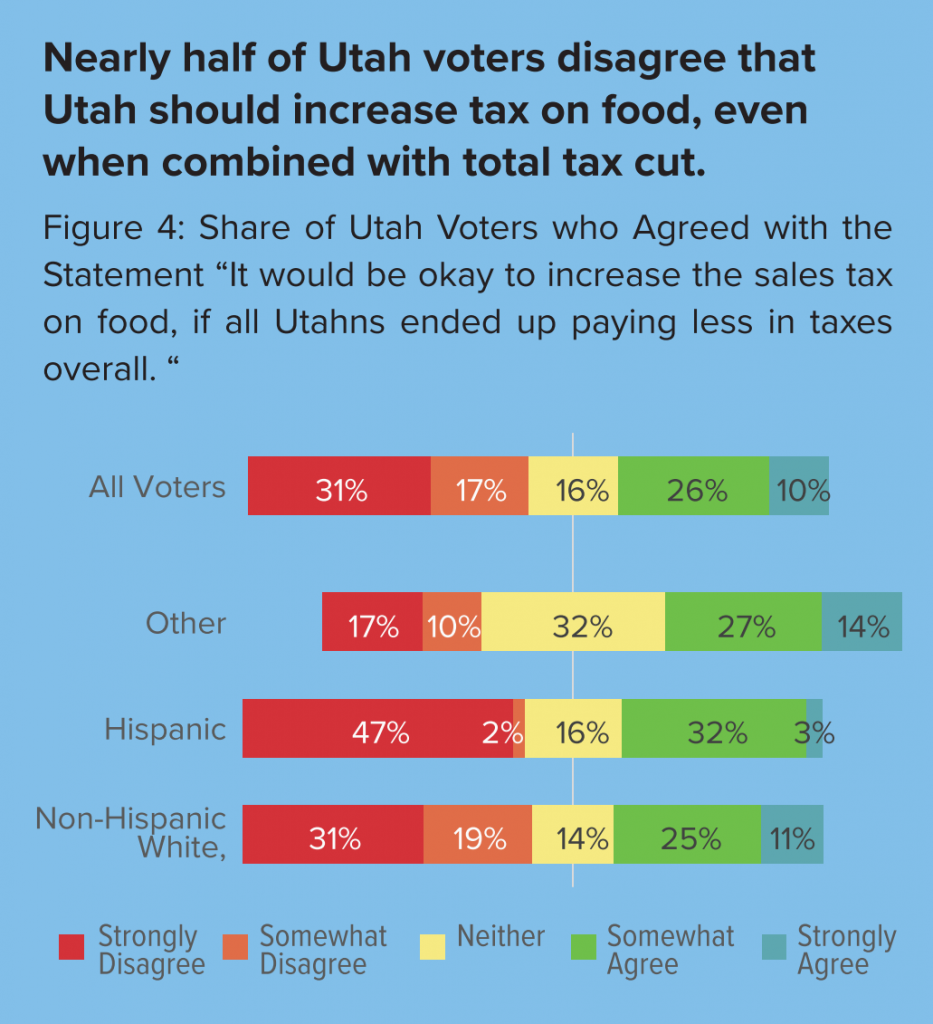

Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a. This graphic shows what this increase means to you. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax.

We appreciate all who have reached out and are grateful for. SALT LAKE CITY The Utah State Legislatures tax reform task force has unveiled its bill that would cut income taxes raise food taxes and tax some services. The Utah County Commission recently voted to adjust property tax rates.

Increase the sales tax on food and food ingredients. First Quarter 2020 Changes. Counties and cities can charge an additional local sales tax of up to 24 for a maximum.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Jay Evensen The Food Tax May Have Doomed Utah Tax Reform Deseret News

How Are Groceries Candy And Soda Taxed In Your State

Cellphone Taxes In Utah Are Among The Nation S Highest Which May Especially Hurt The Poor Here

Every State With A Progressive Tax Also Taxes Retirement Income

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

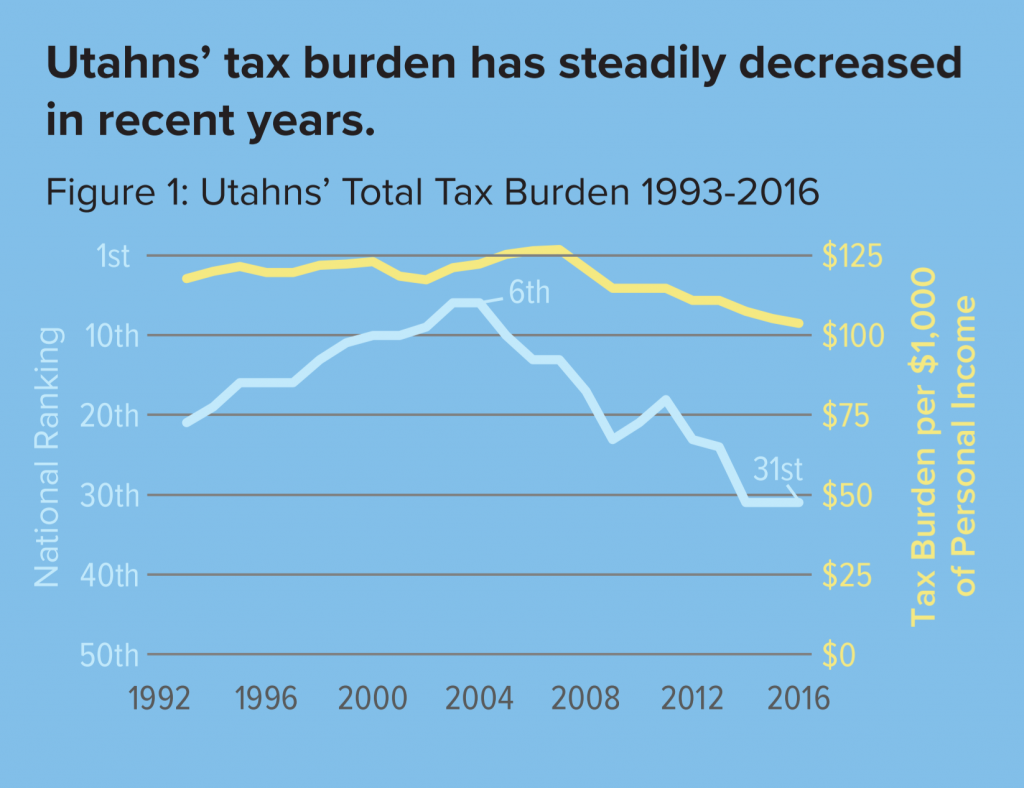

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Is Food Taxable In Utah Taxjar

Bill Eliminating Sales Tax On Food To Be Reintroduced In Utah Legislature

2022 Property Taxes By State Report Propertyshark

Tax Revenue In Most States Surpasses Pre Pandemic Growth Trend The Pew Charitable Trusts

Travis Campbell For Utah House

Is Food Taxable In North Carolina Taxjar

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Even A 14 Cent Food Tax Could Lead To Healthier Choices

Thousands Of Utah Kids Are Going Hungry During Pandemic

Every State With A Progressive Tax Also Taxes Retirement Income

Utah Republicans Retaliate Against Democrats For Misleading Tax Reform Mailers